Sykes: Home of the Staycation

Our turn of the year campaign is sure to get you in the mood to plan your next getaway...

A review by Sykes Holiday Cottages and Oxford Economics

The UK’s short-term letting (STL) industry was growing rapidly in the years prior to the pandemic, but when the country experienced a staycation boom from around June 2020, supply and demand elevated even further.

However, as a result of this sudden growth, an evidence gap has emerged. There is currently little comprehensive quantitative evidence on the positive impact of the STL industry’s growth, but at the same time, concerns have emerged as to the potential effect on the UK housing market.

To help fill that gap, we’ve worked with The Short Term Accommodation Association (STAA), the trade association for the STL sector, commissioning Oxford Economics to undertake an independent quantitative analysis to understand the sector’s impact.

From the demand and spending of tourists travelling to STLs, to the employment opportunities across the country, we wanted to highlight the positive power our industry has to offer. Key findings include:

With the government launching a public review into the impact of STLs earlier this year, there is the potential for new regulatory measures to be introduced. However, we hope the evidence provided in this research can help to play a role in this review – guiding conversations and allowing us to engage with policymakers to help protect the enormous value our sector generates.

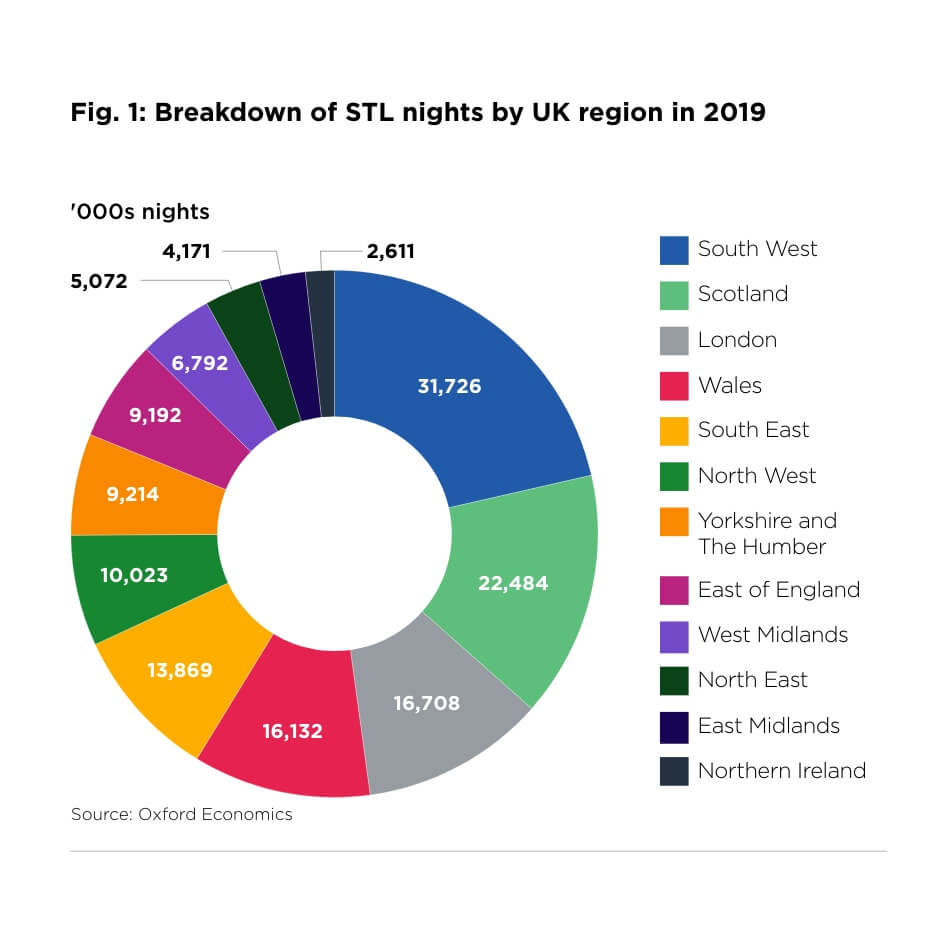

Following a period of rapid growth, total nights in STLs in the UK reached almost 148 million in 2019 (Figure 1). Overnight stays are not evenly spread across the UK, with the likes of the South West, Scotland, London and Wales accounting for almost 60% of nights. However, pockets within all regions still benefited from this increased demand, whether that be the holiday let owners or local economies.

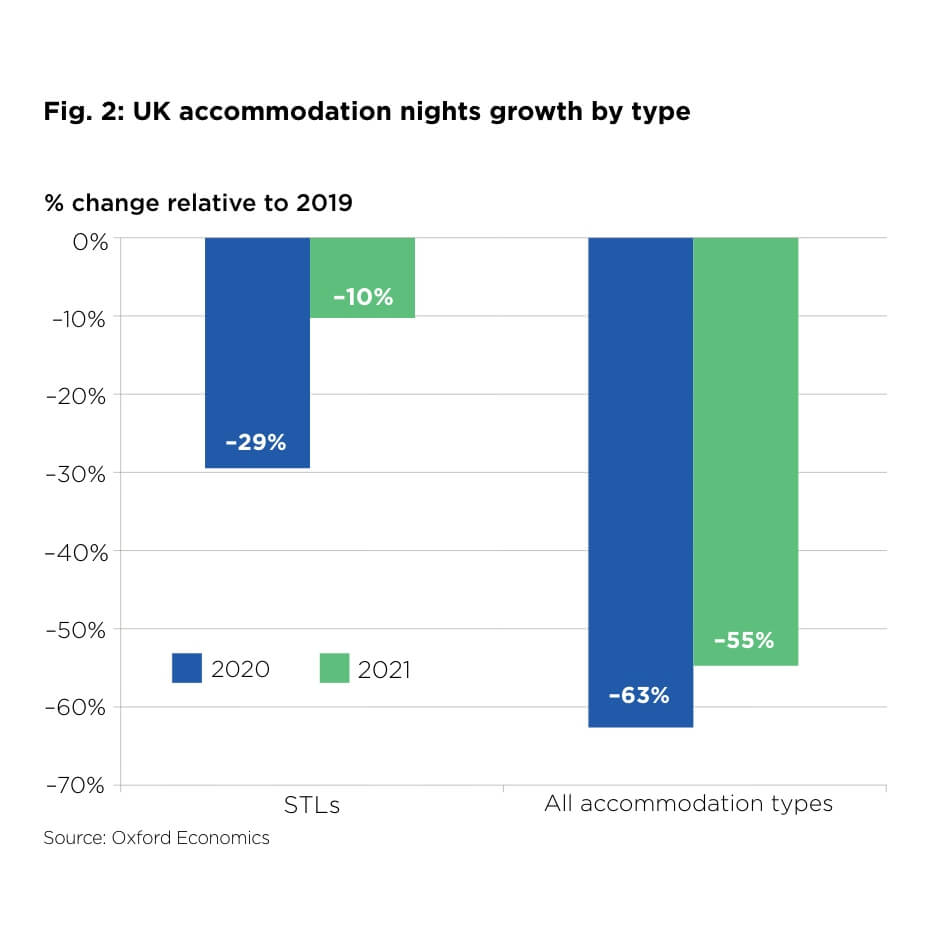

Unsurprisingly, the disruption created by the pandemic led to a dramatic initial fall in activity in 2020, with nights spent in accommodation reducing by 63% compared to 2019, but the market rebounded relatively quickly thanks to the staycation boom that followed.

There are a number of reasons for this quick rebound, including the introduction of foreign travel restrictions which made UK accommodation options more attractive in general, as well as the changing consumer requirements which meant that STLs were the safest travel option.

As a result of this latter point, the STL market reported a faster recovery than all other UK accommodation types, with the number of nights spent in STLs in 2021 already back up to 90% of 2019 levels (Figure 2). STLs also doubled their market share between 2019 and 2021, which not only highlights the demand for STLs, but also shows the importance they played in propping up domestic tourism during the height of the pandemic.

The economic impact associated with STLs goes further than the booking fees, with additional economic benefits for the immediate area supported through guest spending.

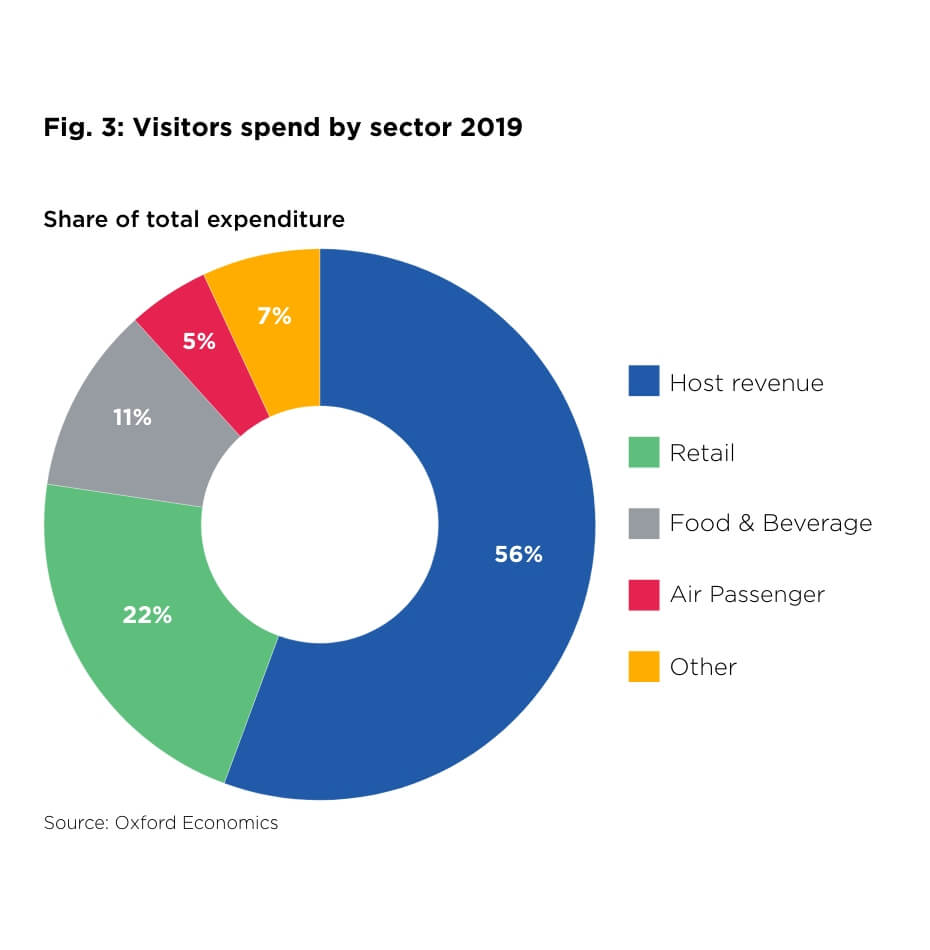

Looking at 2019 as a typical year (Figure 3), more than half of total visitor spend was allocated to the accommodation itself, with 56% going directly to the host. In monetary terms this generated £14.2 billion in revenue across the whole of the UK that year. Meanwhile, the retail and the food and beverage sectors were other large beneficiaries of visitor spend in 2019, making up 22% and 11%, respectively – a composition that didn’t change significantly during the pandemic either.

The share of visitor spending linked to STL activity versus all other tourism activity has increased dramatically in recent years – accounting for 23% of total spending by tourists in 2021, compared to 14% in 2019 (Figure 4). In monetary terms, spending declined across the board during the pandemic, but spending by STL-linked tourists remained more resilient than those staying at all other accommodation types during the pandemic.

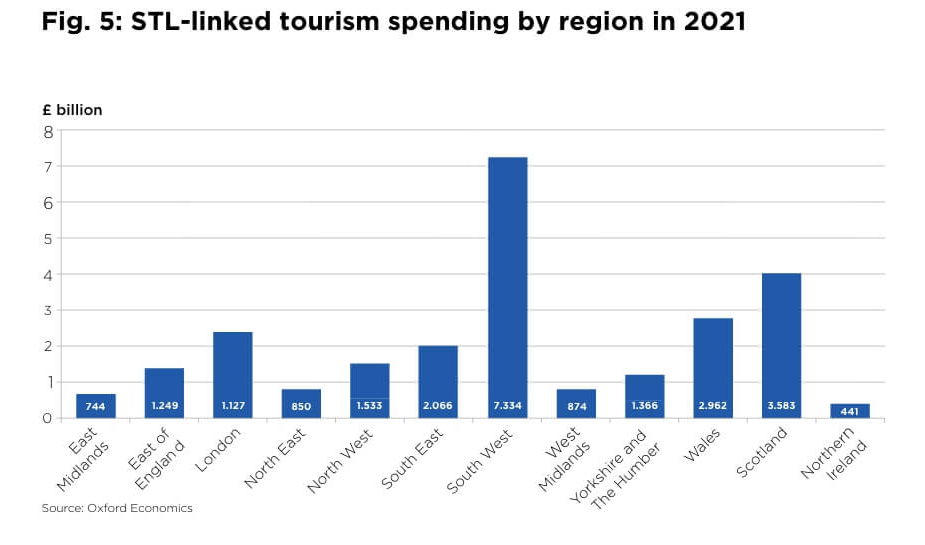

From a regional perspective, this picture varies slightly depending on the area, with rural regions reaping more rewards from STL spending activity than urban areas (Figure 5). For example, the South West, Wales, and Scotland are traditional and established destinations for the STL sector, whereas urban regions like London typically tend to rely less heavily on STL-linked spending (Figure 6).

However, some regions have seen a shift in spending towards urban STLs between 2019 and 2021. For example, the East Midlands and South East saw urban locations take a higher proportion of total STL-linked spending post-pandemic. Whereas, in contrast, urban spending in Scotland and Northern Ireland has taken a larger hit than rural, and more so than the UK overall for that matter.

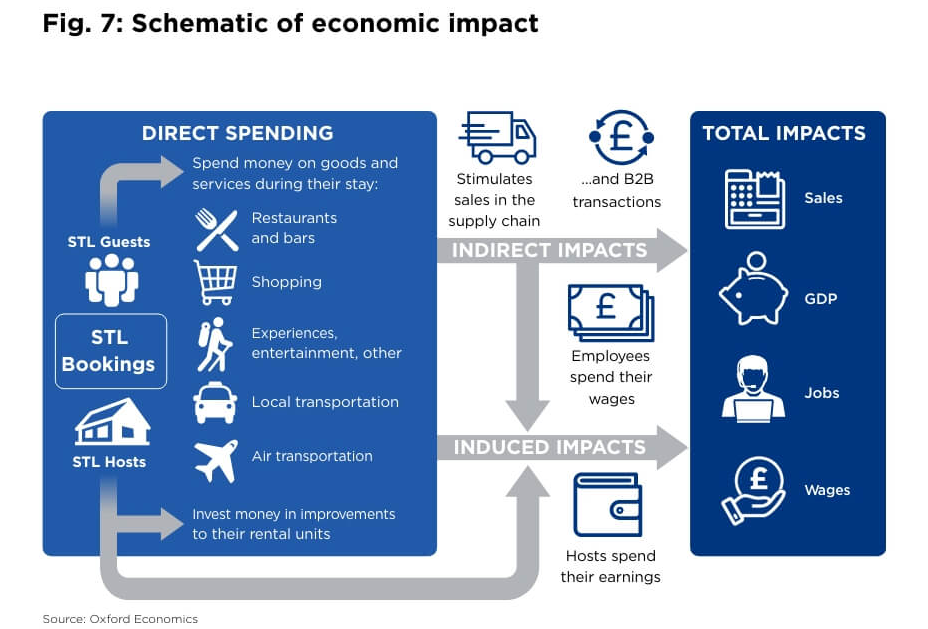

The economic impact of STLs in the UK spans both the direct spending of the hosts and guests in the area surrounding the holiday let, alongside the indirect or so-called induced contributions that stem from the economic activity along the supply chain of this spending – whether that be the wholesalers that produce the items hosts spend money on, or the employees they pay to run their let (Figure 7).

As of 2021, the direct spending of the STL industry contributed £14.1 billion to the UK’s GDP, with the indirect and induced impact contributing a further £6.0 billion and £7.6 billion respectively. Putting those numbers into context, that means that STL activities contributed 1.4% to total UK GDP last year.

This figure does not vary massively from the contribution of STLs to GDP pre-pandemic, however, the share of STL versus total tourism GDP increased by 11% between 2019 and 2021- now accounting for an estimated 24% of total tourism GDP due to the industry’s strong recovery.

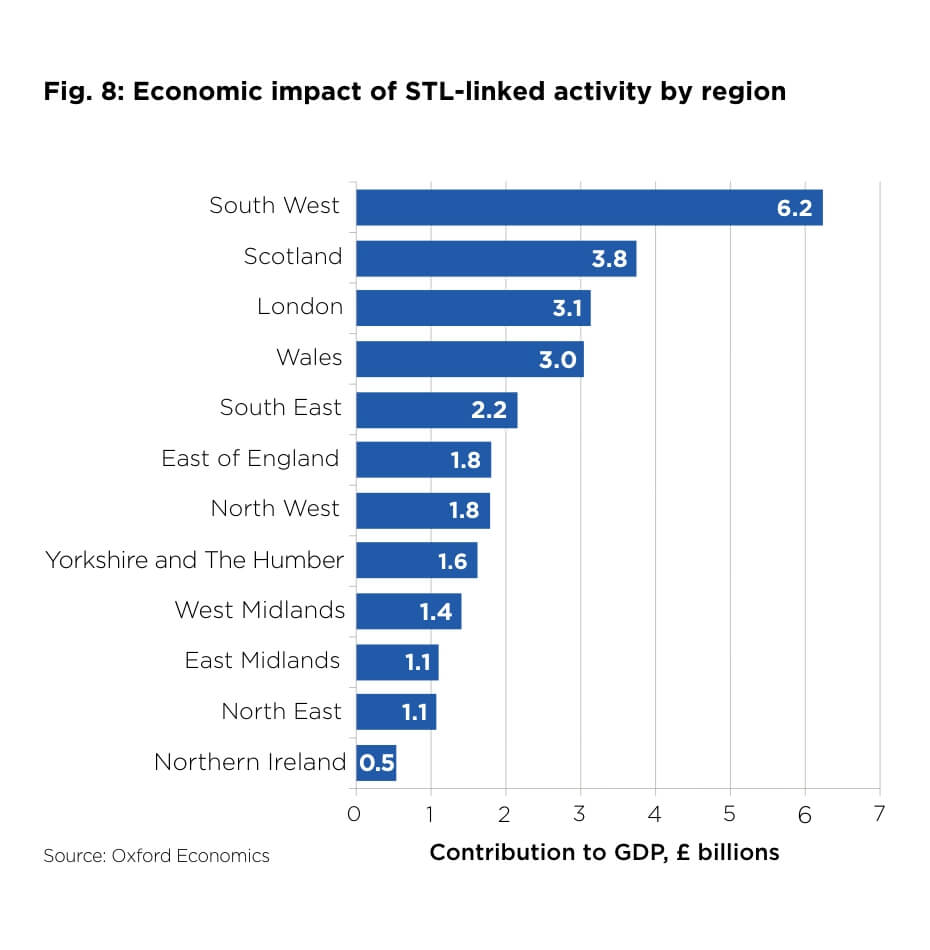

Breaking down these headline figures, we see huge variation in the contribution of STLs to GDP at a regional level, with locations typically classified as rural once again taking a larger share of the impact. In 2021, the STL industry contributed £6.2 billion to GDP in the South West, more than double the value of output in any other region apart from Scotland (£3.8 billion). Next up were London and Wales, where the total economic contribution to GDP in 2021 was more than £3 billion (Figure 8).

The importance of the economic footprint of STLs at a regional level, relative to overall regional GDP, also varies. For example, the regions that we found to be typically most reliant on STL-linked tourism are Wales and the South West (Figure 9), where it contributes towards more than 4% of total GDP, around double that of the remaining regions of the UK. These are home to some of the country’s most popular rural holiday locations that will continue to be key destinations for UK tourists.

The STL sector generates employment across the economy. There is both the direct impact for the firms and sectors where visitors spend money, as well as the indirect impact across businesses that supply goods and services to these tourist-facing firms as well as to hosts.

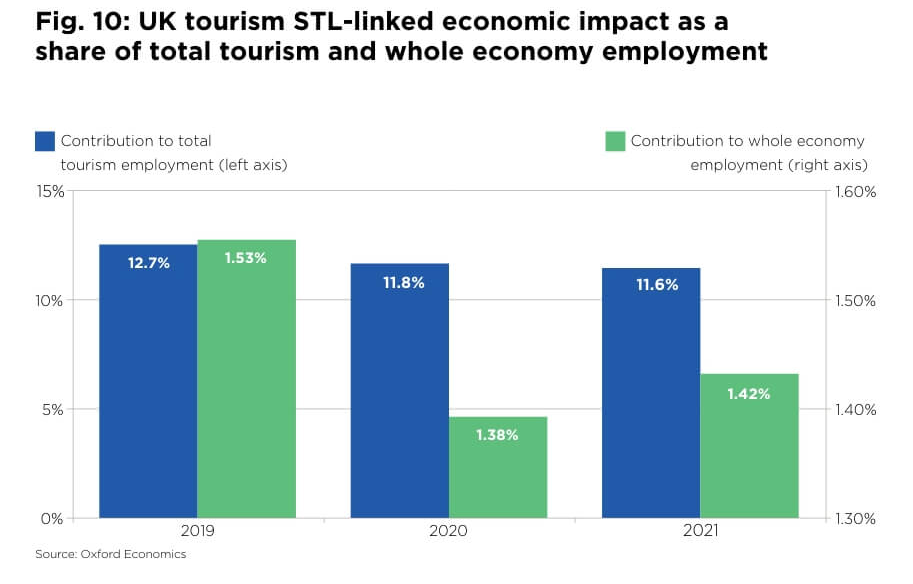

Overall, STL activities supported close to 500,000 jobs as of 2021, making up around 12% of total tourism employment and 1.4% of whole economy employment (Figure 10).

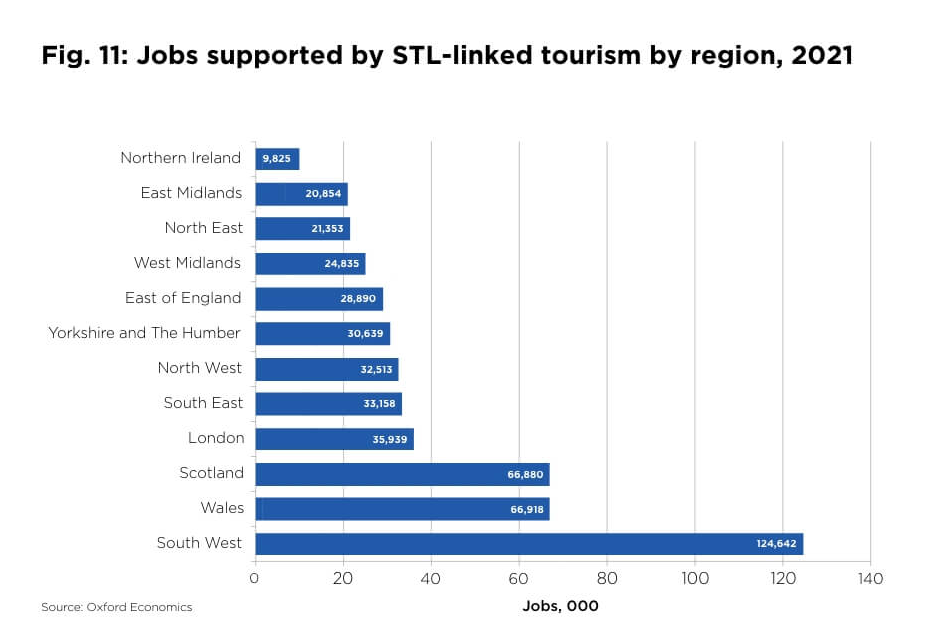

Once again, the contribution to employment from STL-linked tourism varies considerably across regions (Figure 11). Around 383,000 jobs, or 77% of this employment, is generated in rural locations, with the remaining 113,000 in urban areas. The regional employment figures highlight key rural destinations such as the South West, Wales, and Scotland, which require greater levels of employment to cope with demand.

Our research has presented compelling evidence that the STL industry matters for the UK economy. Its economic footprint was growing prior to the pandemic, and this only looks set to continue.

STLs truly are the economic lifeblood of many parts of the UK, driving spending, providing direct employment and supporting local businesses alike. Moreover, the relative importance of the STL market is proportionately largest in regions of the UK where there is a lower-than-average household income, meaning it is an even more vital source of GDP for these areas.

There is much debate around the impact of the sector on the UK housing market, but with potentially hundreds of factors at play when it comes to housing and rental prices, it is hard to demonstrate the exact impact of each. However, if you compare the very strong growth in STL incidence in recent years to average house and rental prices in the UK, the latter has displayed a far more stable pattern up to the pandemic – thus suggesting that the correlation between the two is far from significant.

At Sykes, our mission is to support the sustainable growth of the STL sector in the UK. That’s why we’ve engaged with the UK government on its review of second home ownership and we continue to work closely with owners to ensure properties are let in a responsible way that supports local communities.

We hope the results from our work with Oxford Economics provides a useful guide to those seeking to weigh up the potential social and economic trade-offs associated with new regulations, demonstrating just how essential short-term letting is to this country.

Are you on the phone to our call centre? Your Customer ID is:

Get involved in the Discussion